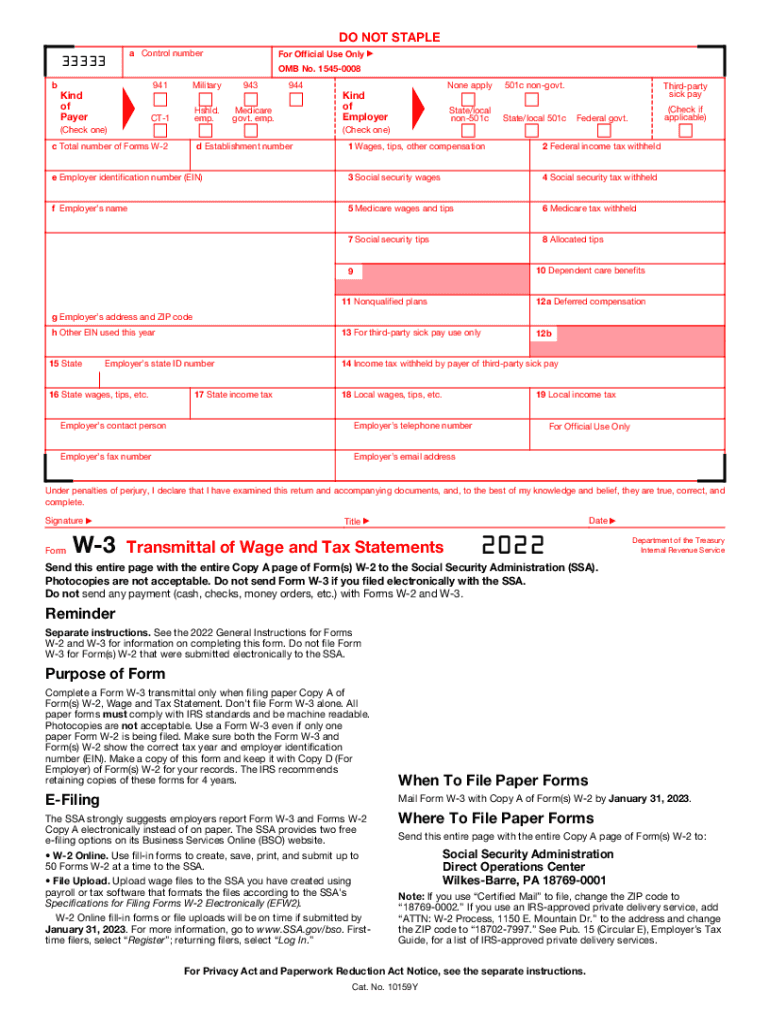

Form W 3 Transmittal of Wage and Tax Statements 2022

What is the Form W-3 Transmittal of Wage and Tax Statements

The Form W-3 is a crucial document used in the United States for reporting wage and tax information to the Internal Revenue Service (IRS). This form serves as a summary of all W-2 forms issued by an employer for a specific tax year. It includes essential details such as the total wages paid, the total federal income tax withheld, and the number of employees for whom W-2 forms were filed. By submitting the W-3, employers ensure that the IRS has accurate records of wages and taxes, which is vital for both compliance and employee tax reporting.

How to Use the Form W-3 Transmittal of Wage and Tax Statements

To effectively use the Form W-3, employers need to compile all W-2 forms issued to employees during the tax year. The W-3 form must be completed with aggregate totals from these W-2 forms. Employers should ensure that the information matches what has been reported on the individual W-2 forms. Once completed, the W-3 can be submitted to the IRS either electronically or by mail, depending on the method chosen for filing W-2 forms. This submission is essential for maintaining accurate tax records and compliance with IRS regulations.

Steps to Complete the Form W-3 Transmittal of Wage and Tax Statements

Completing the Form W-3 involves several key steps:

- Gather all W-2 forms issued to employees for the tax year.

- Enter the total number of W-2 forms in the designated field on the W-3.

- Calculate the total wages paid and total federal income tax withheld from all W-2 forms.

- Fill in the employer's information, including name, address, and Employer Identification Number (EIN).

- Review all entries for accuracy before submission.

Once the form is completed, it can be filed with the IRS alongside the W-2 forms to ensure compliance and accurate reporting.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines for filing the Form W-3. The deadline for submitting the W-3, along with the W-2 forms, is typically January thirty-first of the year following the tax year. If filing electronically, employers may have an extended deadline, usually until the end of March. It is essential to be aware of these deadlines to avoid penalties and ensure compliance with IRS regulations.

Legal Use of the Form W-3 Transmittal of Wage and Tax Statements

The Form W-3 is legally required for employers who issue W-2 forms to their employees. This form must be submitted to the IRS to report the total wages and taxes withheld for the tax year. Failure to submit the W-3 can result in penalties, including fines and interest on unpaid taxes. Employers should ensure that they comply with all IRS guidelines regarding the use of the W-3 to maintain legal standing and avoid potential issues with tax reporting.

Key Elements of the Form W-3 Transmittal of Wage and Tax Statements

Several key elements must be included on the Form W-3 to ensure it is complete and accurate:

- Employer's name and address

- Employer Identification Number (EIN)

- Total number of W-2 forms submitted

- Total wages paid

- Total federal income tax withheld

Including these elements ensures that the form meets IRS requirements and provides a clear summary of the employer's wage and tax reporting for the year.

Quick guide on how to complete 2022 form w 3 transmittal of wage and tax statements

Complete Form W 3 Transmittal Of Wage And Tax Statements seamlessly on any device

Online document management has gained immense popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the essential tools to generate, modify, and electronically sign your documents swiftly without delays. Manage Form W 3 Transmittal Of Wage And Tax Statements on any platform with the airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

How to modify and electronically sign Form W 3 Transmittal Of Wage And Tax Statements effortlessly

- Obtain Form W 3 Transmittal Of Wage And Tax Statements and click on Get Form to begin.

- Employ the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Form W 3 Transmittal Of Wage And Tax Statements and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 form w 3 transmittal of wage and tax statements

Create this form in 5 minutes!

People also ask

-

What is the 3 2018 transmittal, and how can airSlate SignNow help?

The 3 2018 transmittal is a standardized form used in various industries for document submissions. airSlate SignNow simplifies the process by allowing users to easily eSign and send these transmittals, ensuring compliance and accuracy throughout the submission process.

-

How does airSlate SignNow ensure the security of the 3 2018 transmittal?

airSlate SignNow employs advanced encryption methods to secure your 3 2018 transmittal documents. This ensures that sensitive information remains confidential between the sender and receiver, providing peace of mind for all users.

-

Are there any integration options available for the 3 2018 transmittal with airSlate SignNow?

Yes, airSlate SignNow offers seamless integration with various applications, enhancing the efficiency of managing your 3 2018 transmittal. You can connect it with popular platforms like Google Drive, Dropbox, and many CRM systems to streamline your workflow.

-

What are the pricing plans for airSlate SignNow related to the 3 2018 transmittal?

airSlate SignNow provides flexible pricing plans tailored to accommodate different business needs. Each plan supports the 3 2018 transmittal process, enabling cost-effective eSigning and document management without hidden fees.

-

What features does airSlate SignNow offer for efficient handling of the 3 2018 transmittal?

Key features include customizable templates, automated workflows, and real-time tracking for your 3 2018 transmittal. These tools help boost productivity by reducing the time spent on paperwork and ensuring documents are processed smoothly.

-

Can I access my 3 2018 transmittal from mobile devices with airSlate SignNow?

Absolutely! airSlate SignNow is mobile-friendly, allowing you to access and manage your 3 2018 transmittal documents from anywhere. This feature is especially beneficial for users who need to handle documents on the go.

-

What are the benefits of using airSlate SignNow for the 3 2018 transmittal?

Using airSlate SignNow for your 3 2018 transmittal streamlines the signing process, saves time, and reduces the risk of errors. Additionally, it enhances collaboration among team members by enabling them to work together on documents in real-time.

Get more for Form W 3 Transmittal Of Wage And Tax Statements

- Sample transmittal letter for articles of incorporation kentucky form

- Sample operating agreement for professional limited liability company pllc kentucky form

- Pllc notices and resolutions kentucky form

- Kentucky sample letter form

- New resident guide kentucky form

- Satisfaction release or cancellation of mortgage by corporation kentucky form

- Satisfaction release or cancellation of mortgage by individual kentucky form

- Partial release of property from mortgage for corporation kentucky form

Find out other Form W 3 Transmittal Of Wage And Tax Statements

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free

- eSign Ohio Car Insurance Quotation Form Mobile